Home > Members > Medicare Plan Members > Medicare Advantage Members > 2026 UW Health Quartz Medicare Advantage

UW Health

Quartz Medicare Advantage plans

About our 2026 UW Health Quartz Medicare Advantage plans

With our 2026 UW Health Quartz Medicare Advantage plans, you have access to all the doctors, specialists, and hospitals in the nationally recognized UW Health, as well as doctors throughout the Quartz Medicare Advantage network. 2026 UW Health Quartz Medicare plans feature:

Get more of the benefits you want

Quartz Care Management

Care Management helps members who have serious health problems. Learn more.

Diabetes prevention and support

Prediabetes and Diabetes programs and support We offer programs and support to help prevent or reverse Diabetes. Send a message in Quartz MyChart or call Customer Service.

Other Health Management Resources:

Health Risk Assessment Survey

A better understanding of your health is just a few clicks away when you complete the online health risk assessment (HRA) survey.*

*Your responses are kept private and will not affect your coverage with Quartz Medicare Advantage.

Health Information

By clicking the links below you will leave the Quartz Medicare Advantage website

Get free, confidential community information 24 hours per day – 7 days per week

Dial 2-1-1 or (608) 246-4357 for State Assistance

211wisconsin.communityos.org for National Assistance

www.211.org Preventive Care and Screenings

Preventive care and screenings

Your Guide to Medicare’s Preventive Services. View brochure.

Quartz dental benefits will put a smile on your face

When looking at Medicare options, one thing to consider is dental coverage. Different Medicare plans offer different options, which can impact your total out-of-pocket costs. Here’s what you should know:

Original Medicare (Parts A and B) does not include dental care, except in certain circumstances

Some private health insurers offer separate dental packages with separate premiums and costs

Some Medicare Advantage plans include dental benefits.

Plans with a range of dental coverage

Quartz Medicare Advantage (HMO) plans include dental benefits through Delta Dental. As a Quartz member, you get discounted rates for services with providers in the Delta Dental Medicare Advantage Network.

Plans feature a range of dental options, from annual cleanings and exams to preventive care and coverage for prosthodontics. Choose what’s right for you. You can also add an optional dental rider for an additional $1,000 dental allowance.

Finding a dentist

With open access, you choose the dentist you want to see. If you see a provider out of the Delta Dental network, you may be balance-billed for the difference of what the provider charges and what is allowed.

If you don’t have a dentist, we can help. Search for a Delta Dental Medicare Advantage dental provider or call (800) 394-5566 (TTY:711)

Travel more, worry less

This plan travels with you! For up to six months, get covered services at in-network costs when traveling nationwide our service area, and the U.S. and its territories, and Wisconsin.

UW Health Quartz Medicare Advantage (HMO) offers extra benefits.

Extra benefits are quick and easy ways to manage your health — leaving you more time to live your life.

Quartz® CashCard

Get one CashCard to use toward multiple items such as a fitness membership and eyewear from an in-network provider. Plus, get $30/quarter to buy over-the-counter health-related items at participating retailers, such as: Walmart, Family Dollar, Walgreens, CVS, and more.. Learn more

Well-living programs

We all have aspects of our health we’d like to improve, and Quartz is your resource to help. From physical health and mental resiliency to social well-being, let us connect you to the right program to support you in well-living. Learn more.

Care management

This program coordinates the care and services for members who need extra support with their medical and social needs.

At no extra cost, a registered nurse will work with you to coordinate your health care services — ensuring you get the care you need. Learn more.

Virtual visits

The UW Health Care Anywhere app or website offers 24/7 online access to non-emergency medical evaluation and management services provided by a physician or other qualified health care professional: $0 copay per visit. Learn more.

Accu-Chek & OneTouch® blood glucose meters and test strips

Access to high-quality supplies to help you manage diabetes. Our preferred brands of blood glucose monitoring supplies are the Accu-Chek and OneTouch® blood glucose meters and their associated test strips.

All are available at no extra cost to you.

The Quartz nourishing meal program

We offer the Quartz Nourishing Meals Program to eligible Quartz Medicare Advantage (HMO) and Dual Eligible members enrolled in a Quartz Care Management program, for members with congestive heart failure, and for members recovering from an in-patient hospital stay or skilled nursing facility stay. Let us handle the cooking so you can focus on your recovery.

Learn more in your plan’s Evidence of Coverage found in your Quartz MyChart account.

Massage therapy for chronic conditions

You receive a 60-minute massage for certain chronic conditions, such as neck pain, lower back pain, fibromyalgia, and Type 2 diabetes. Get 6-12 visits a year with a $0-$15 copay per visit.

Acupuncture benefit

Members may receive up to 20 Medicare-covered treatments a year for chronic low back pain with a network provider. $20 copay per treatment.

See details and access to your plan documents based on your plan below.

2026 UW Health Quartz Medicare Advantage Value Plan (No Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 UW Health Quartz Medicare Advantage Value plan (No Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 UW Health Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage | Annual Notice of Change

Search for network providers

|

2026 UW Health Quartz Medicare Advantage (HMO) - Value plan (No RX)

|

|

|---|---|

|

Monthly premium |

$0 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$15 |

|

Specialist office visit copay |

$40 |

|

Urgent care visits* |

$45 |

|

Emergency care visits* (copay waived if admitted within three days) |

$130 |

|

Lab services per day (not per lab) |

$20 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$4,900 |

|

Inpatient hospital coverage copay per day |

Days 1 - 7: $200 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

ASCs: $250 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: Annual initial routine eye exam copay |

$0 |

|

Vision: Annual limit for contacts, frames, lenses, and upgrades |

$300 |

|

Hearing: Annual routine hearing exam copay |

$35 |

|

Hearing: Plan payment every two years for hearing aids |

$1,500 |

|

Dental: Annual limit** |

$2,000 |

|

Dental: Basic and major procedures (e.g., cleanings, fillings, crowns, and oral surgery) |

Covered 100% |

|

Dental: Prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: Optional rider for an extra $1,000 coverage |

$48 per month |

|

Quartz® CashCard (toward fitness memberships) |

$250 per year |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

2026 UW Health Quartz Medicare Advantage Elite Plan (No Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 UW Health Quartz Medicare Advantage Elite plan (No Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 UW Health Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage | Annual Notice of Change

Search for network providers

|

2026 UW Health Quartz Medicare Advantage (HMO) - Elite plan (No RX)

|

|

|---|---|

|

Monthly premium |

$70 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$10 |

|

Specialist office visit copay |

$35 |

|

Urgent care visits* |

$35 |

|

Emergency care visits* (copay waived if admitted within three days) |

$150 |

|

Lab services per day (not per lab) |

$15 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$4,200 |

|

Inpatient hospital coverage copay per stay

|

$350 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

ASCs: $100 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: Annual initial routine eye exam copay |

$0 |

|

Vision: Annual limit for contacts, frames, lenses, and upgrades |

$350 |

|

Hearing: Annual routine hearing exam copay |

$30 |

|

Hearing: Plan payment every two years for hearing aids |

$1,500 |

|

Dental: Annual limit** |

$1,000 |

|

Dental: Basic and major procedures (e.g., cleanings, fillings, crowns, and oral surgery) |

Covered 100% |

|

Dental: Prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: Optional rider for an extra $1,000 coverage |

$48 per month |

|

Quartz® CashCard (toward fitness memberships) |

$500 per year |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

2026 UW Health Quartz Medicare Advantage Basic plan (No Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 UW Health Quartz Medicare Advantage Basic D plan (Includes Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 UW Health Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage

Search for network providers

|

2026 UW Health Quartz Medicare Advantage (HMO) - Basic D plan

|

|

|---|---|

|

Monthly premium |

$0 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$25 |

|

Specialist office visit copay |

$75 |

|

Urgent care visits* |

$50 |

|

Emergency care visits* (copay waived if admitted within three days) |

$130 |

|

Lab services per day (not per lab) |

$50 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$6,400 |

|

Inpatient hospital coverage copay per day |

Days 1 - 7: $300 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

ASCs: $415 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: Annual initial routine eye exam copay |

$0 |

|

Vision: Annual limit for contacts, frames, lenses, and upgrades |

$75 |

|

Hearing: Annual routine hearing exam copay |

$40 |

|

Hearing: Plan payment every two years for hearing aids |

$800 |

|

Dental: Annual limit** |

No coverage |

|

Dental: Oral exam and prophylaxis (cleaning) once per calendar year |

Covered 100% |

|

Dental: Prosthodontics (e.g., removable and fixed |

No coverage |

|

Dental: Optional rider for an extra $1,000 coverage |

$59 per month |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

Basic D 2026 prescription drug coverage

Quartz Medicare Advantage has a list of all covered drugs that you can search online or download. The drug list organizes medications into six tiers of costs.

What you pay for prescription drugs in 2026

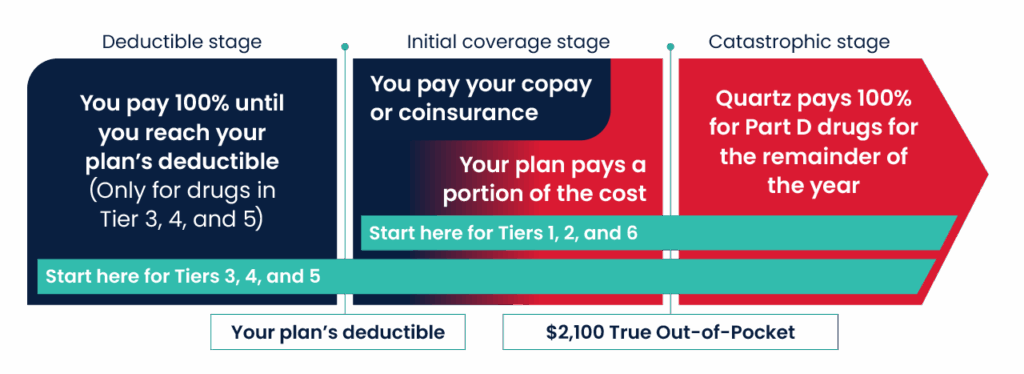

Your plan has a deductible of $270 for drugs only in Tiers 3, 4, and 5. Deductible does not apply to medications in Tiers 1, 2, or 6. Once you reach the deductible, they are subject to a copay or coinsurance. After reaching the annual TrOOP (True Out-of-Pocket) limit of $2,100, your plan will cover all of your Part D drug costs for the rest of the year. See the image below to learn about the coverage stages.

|

|

Deductible applies?

|

Your share

|

30-day

|

61 to 100-day

|

31 to 60-day

|

|---|---|---|---|---|---|

|

Tier 1 (Preferred Generic) |

× No |

Copay |

$2 |

$4 |

$5 |

|

Tier 2 (Generic) |

× No |

Copay |

$10 |

$20 |

$25 |

|

Tier 3* (Preferred brand) |

✓ Yes |

Coinsurance |

20% |

20% |

20% |

|

Tier 4 (Non-preferred drugs) |

✓ Yes |

Coinsurance |

40% |

40% |

40% |

|

Tier 5** (Specialty) |

✓ Yes |

Coinsurance |

30% retail only |

Not available** |

Not available** |

|

Tier 6*** (Select Care drugs) |

× No |

Copay |

$0 |

$0 |

$0 |

You can fill your prescriptions at any in-network retail or mail-order pharmacy.

*Tier 3 includes many common brand-name drugs, some higher-cost generic drugs, and insulin.

**Tier 5 (Specialty) 30-day supply available in retail locations only. Not available through mail-order pharmacy benefit.

***Tier 6 includes many low-cost medications that treat diabetes, high blood pressure, high cholesterol, osteoporosis, and other conditions.

This plan is available in these Wisconsin counties: Columbia, Dane, and Green.

2026 UW Health Quartz Medicare Advantage Core D Plan (Includes Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 UW Health Quartz Medicare Advantage Core D plan (Includes Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 UW Health Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage | Annual Notice of Change

Search for network providers

|

2026 UW Health Quartz Medicare Advantage (HMO) - Core D plan (Includes RX)

|

|

|---|---|

|

Monthly premium |

$34 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$20 |

|

Specialist office visit copay |

$65 |

|

Urgent care visits* |

$50 |

|

Emergency care visits* (copay waived if admitted within three days) |

$130 |

|

Lab services per day (not per lab) |

$25 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$5,400 |

|

Inpatient hospital coverage copay per day |

Days 1 - 7: $270 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

ASCs: $375 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: Annual initial routine eye exam copay |

$0 |

|

Vision: Annual limit for contacts, frames, lenses, and upgrades |

$150 |

|

Hearing: Annual routine hearing exam copay |

$40 |

|

Hearing: Plan payment every two years for hearing aids |

$1,000 |

|

Dental: annual limit** |

$400 |

|

Dental: Basic and major procedures (e.g., cleanings, fillings, crowns, and oral surgery) |

Covered 100% |

|

Dental: Prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: Optional rider for an extra $1,000 coverage |

$59 per month |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

Core D 2026 prescription drug coverage

Quartz Medicare Advantage has a list of all covered drugs that you can search online or download. The drug list organizes medications into six tiers of costs.

What you pay for prescription drugs in 2026

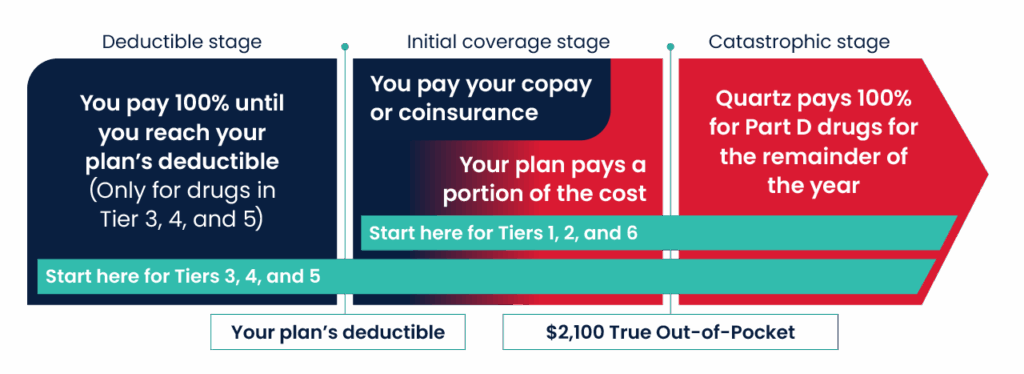

Your plan has a deductible of $270 for drugs only in Tiers 3, 4, and 5. Deductible does not apply to medications in Tiers 1, 2, or 6. Once you reach the deductible, they are subject to a copay or coinsurance. After reaching the annual TrOOP (True Out-of-Pocket) limit of $2,100, your plan will cover all of your Part D drug costs for the rest of the year. See the image below to learn about the coverage stages.

|

|

Deductible applies?

|

Your share

|

30-day

|

61 to 100-day

|

31 to 60-day

|

|---|---|---|---|---|---|

|

Tier 1 (Preferred Generic) |

× No |

Copay |

$2 |

$4 |

$5 |

|

Tier 2 (Generic) |

× No |

Copay |

$10 |

$20 |

$25 |

|

Tier 3* (Preferred brand) |

✓ Yes |

Coinsurance |

20% |

20% |

20% |

|

Tier 4 (Non-preferred drugs) |

✓ Yes |

Coinsurance |

40% |

40% |

40% |

|

Tier 5** (Specialty) |

✓ Yes |

Coinsurance |

30% retail only |

Not available** |

Not available** |

|

Tier 6*** (Select Care drugs) |

× No |

Copay |

$0 |

$0 |

$0 |

You can fill your prescriptions at any in-network retail or mail-order pharmacy.

*Tier 3 includes many common brand-name drugs, some higher-cost generic drugs, and insulin.

**Tier 5 (Specialty) 30-day supply available in retail locations only. Not available through mail-order pharmacy benefit.

***Tier 6 includes many low-cost medications that treat diabetes, high blood pressure, high cholesterol, osteoporosis, and other conditions.

This plan is available in these Wisconsin counties: Columbia, Dane, and Green.

2026 UW Health Quartz Medicare Advantage Value D Plan (Includes Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 UW Health Quartz Medicare Advantage Value D plan (Includes Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 UW Health Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage | Annual Notice of Change

Search for network providers

|

2026 UW Health Quartz Medicare Advantage (HMO) - Value D plan (Includes RX)

|

|

|---|---|

|

Monthly premium |

$106 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$15 |

|

Specialist office visit copay |

$50 |

|

Urgent care visits* |

$45 |

|

Emergency care visits* (copay waived if admitted within three days) |

$130 |

|

Lab services per day (not per lab) |

$20 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$4,900 |

|

Inpatient hospital coverage copay per day |

Days 1 - 7: $225 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

ASCs: $300 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: Annual initial routine eye exam copay |

$0 |

|

Vision: Annual limit for contacts, frames, lenses, and upgrades |

$250 |

|

Hearing: Annual routine hearing exam copay |

$35 |

|

Hearing: Plan payment every two years for hearing aids |

$1,250 |

|

Dental: Annual limit** |

$475 |

|

Dental: Basic and major procedures (e.g., cleanings, fillings, crowns, and oral surgery) |

Covered 100% |

|

Dental: Prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: Optional rider for an extra $1,000 coverage |

$48 per month |

|

Quartz® CashCard (toward fitness memberships) |

$250 per year |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

2026 Value D prescription drug coverage

Quartz Medicare Advantage has a list of all covered drugs that you can search online or download. The drug list organizes medications into six tiers of costs.

What you pay for prescription drugs in 2026

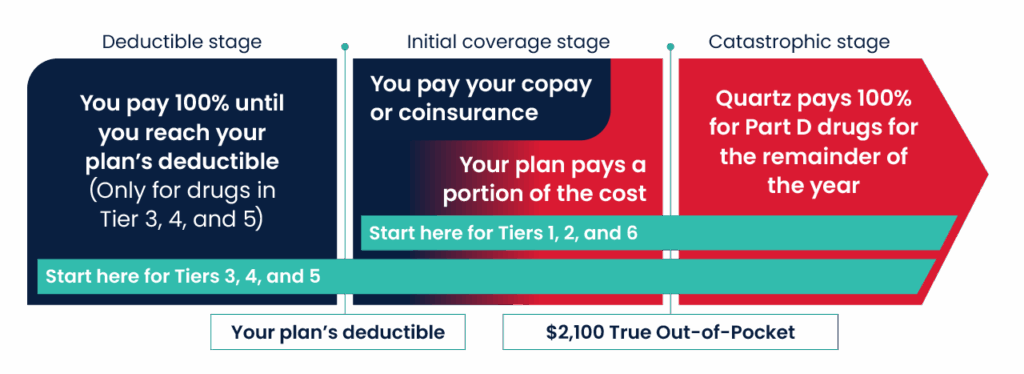

Your plan has a deductible of $225 for drugs only in Tiers 3, 4, and 5. Deductible does not apply to medications in Tiers 1, 2, or 6. Once you reach the deductible, they are subject to a copay or coinsurance. After reaching the annual TrOOP (True Out-of-Pocket) limit of $2,100, your plan will cover all of your Part D drug costs for the rest of the year. See the image below to learn about the coverage stages.

|

|

Deductible applies?

|

Your share

|

30-day

|

61 to 100-day

|

31 to 60-day

|

|---|---|---|---|---|---|

|

Tier 1 (Preferred Generic) |

× No |

Copay |

$2 |

$4 |

$5 |

|

Tier 2 (Generic) |

× No |

Copay |

$10 |

$20 |

$25 |

|

Tier 3* (Preferred brand) |

✓ Yes |

Coinsurance |

20% |

20% |

20% |

|

Tier 4 (Non-preferred drugs) |

✓ Yes |

Coinsurance |

40% |

40% |

40% |

|

Tier 5** (Specialty) |

✓ Yes |

Coinsurance |

30% retail only |

Not available** |

Not available** |

|

Tier 6*** (Select Care drugs) |

× No |

Copay |

$0 |

$0 |

$0 |

You can fill your prescriptions at any in-network retail or mail-order pharmacy.

*Tier 3 includes many common brand-name drugs, some higher-cost generic drugs, and insulin.

**Tier 5 (Specialty) 30-day supply available in retail locations only. Not available through mail-order pharmacy benefit.

***Tier 6 includes many low-cost medications that treat diabetes, high blood pressure, high cholesterol, osteoporosis, and other conditions.

This plan is available in these Wisconsin counties: Columbia, Dane, and Green.

2026 UW Health Quartz Medicare Advantage Elite D Plan (Includes Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 UW Health Quartz Medicare Advantage Elite D plan (Includes Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 UW Health Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage | Annual Notice of Change

Search for network providers

|

2026 UW Health Quartz Medicare Advantage (HMO) - Elite D plan (Includes Rx)

|

|

|---|---|

|

Monthly premium |

$162 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$10 |

|

Specialist office visit copay |

$35 |

|

Urgent care visits* |

$35 |

|

Emergency care visits* (copay waived if admitted within three days) |

$150 |

|

Lab services per day (not per lab) |

$15 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$4,200 |

|

Inpatient hospital coverage copay per stay

|

$450 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

ASCs: $100 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: Annual initial routine eye exam copay |

$0 |

|

Vision: Annual limit for contacts, frames, lenses, and upgrades |

$300 |

|

Hearing: Annual routine hearing exam copay |

$30 |

|

Hearing: Plan payment every two years for hearing aids |

$1,500 |

|

Dental: annual limit** |

$575 |

|

Dental: Basic and major procedures (e.g., cleanings, fillings, crowns, and oral surgery) |

Covered 100% |

|

Dental: Prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: Optional rider for an extra $1,000 coverage |

$48 per month |

|

Quartz® CashCard (toward fitness memberships) |

$500 per year |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

2026 Elite D prescription drug coverage

Quartz Medicare Advantage has a list of all covered drugs that you can search online or download. The drug list organizes medications into six tiers of costs.

What you pay for prescription drugs in 2026

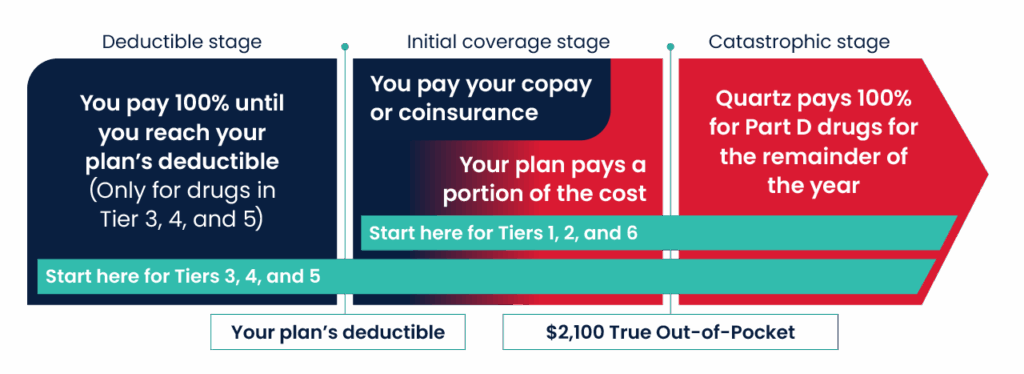

Your plan has a deductible of $200 for drugs only in Tiers 3, 4, and 5. Deductible does not apply to medications in Tiers 1, 2, or 6. Once you reach the deductible, they are subject to a copay or coinsurance. After reaching the annual TrOOP (True Out-of-Pocket) limit of $2,100, your plan will cover all of your Part D drug costs for the rest of the year. See the image below to learn about the coverage stages.

|

|

Deductible applies?

|

Your share

|

30-day

|

61 to 100-day

|

31 to 60-day

|

|---|---|---|---|---|---|

|

Tier 1 (Preferred Generic) |

× No |

Copay |

$2 |

$4 |

$5 |

|

Tier 2 (Generic) |

× No |

Copay |

$10 |

$20 |

$25 |

|

Tier 3* (Preferred brand) |

✓ Yes |

Coinsurance |

20% |

20% |

20% |

|

Tier 4 (Non-preferred drugs) |

✓ Yes |

Coinsurance |

40% |

40% |

40% |

|

Tier 5** (Specialty) |

✓ Yes |

Coinsurance |

30% retail only |

Not available** |

Not available** |

|

Tier 6*** (Select Care drugs) |

× No |

Copay |

$0 |

$0 |

$0 |

You can fill your prescriptions at any in-network retail or mail-order pharmacy.

*Tier 3 includes many common brand-name drugs, some higher-cost generic drugs, and insulin.

**Tier 5 (Specialty) 30-day supply available in retail locations only. Not available through mail-order pharmacy benefit.

***Tier 6 includes many low-cost medications that treat diabetes, high blood pressure, high cholesterol, osteoporosis, and other conditions.

This plan is available in these Wisconsin counties: Columbia, Dane, and Green.