Home > Join Quartz > Join a Medicare Plan > Quartz Medicare Advantage > Medicare Advantage Plans > 2026 Gundersen Quartz Medicare Advantage

Explore Gundersen Quartz Medicare Advantage plans

Experience neighborly service and coverage with our 2026 Gundersen Quartz Medicare Advantage (HMO) plan options.

Enjoy quality coverage from two trusted names in Medicare

Quartz Medicare Advantage, in partnership with Emplify Health by Gundersen, offers you six plans with various benefits, prescription drug coverage, and valuable extras – all for as low as $0 per month.

All our 2026 plans include:

$0 copay for preventive services

$0 copay for an initial routine eye exam

Nourishing meal program

Care Management team

Travel benefits outside our service area, the U.S., and its territories

Diabetes prevention and support

Mental well-being programs

Quartz Champion for local, personalized support

About our 2026 Gundersen Quartz Medicare Advantage plans

With our 2026 Gundersen Quartz Medicare Advantage plans, you have access to all the doctors, specialists, and hospitals in the nationally recognized Emplify Health by Gundersen system, as well as doctors throughout the Quartz Medicare Advantage Network. 2026 Gundersen Quartz Medicare Advantage plans feature:

- Plan options starting at $0/month

- Direct access to Emplify Health by Gundersen

- Access to the programs and services to support overall health and well-being

- Travel benefits outside our service area and the U.S. and its territories

Explore more details of our six plan options below.

2026 Gundersen Quartz Medicare Advantage Value plan (no Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 Gundersen Quartz Medicare Advantage Value plan (no Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 Gundersen Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage

Annual Notice of Change | Search for network providers

|

2026 Gundersen Quartz Medicare Advantage (HMO) - Value plan (no Rx)

|

|

|---|---|

|

Monthly premium |

$0 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$15 |

|

Specialist office visit copay |

$50 |

|

Urgent care visits* |

$60 |

|

Emergency care visits* (copay waived if admitted within three days) |

$150 |

|

Lab services per day (not per lab) |

$10 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$4,200 |

|

Inpatient hospital coverage copay per day |

Days 1 - 6: $225 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

$200 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: annual initial routine eye exam copay |

$0 |

|

Vision: annual limit for contacts, frames, lenses, and upgrades |

$225 |

|

Hearing: annual routine hearing exam copay |

$35 |

|

Hearing: plan payment every two years for hearing aids |

$1,500 |

|

Dental: annual limit** |

$1,000 |

|

Dental: basic and major procedures (e.g., cleanings, fillings, crowns, and oral surgery) |

Covered 100% |

|

Dental: prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: optional rider for an extra $1,000 coverage |

$48 per month |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

This plan is available in these states and counties:

- Iowa: Allamakee, Fayette, and Winneshiek

- Wisconsin: Buffalo, La Crosse, Monroe, Pepin, and Trempealeau

2026 Gundersen Quartz Medicare Advantage Elite plan (no Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 Gundersen Quartz Medicare Advantage Elite plan (no Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 Gundersen Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage

Annual Notice of Change | Search for network providers

|

2026 Gundersen Quartz Medicare Advantage (HMO) - Elite plan (no Rx)

|

|

|---|---|

|

Monthly premium |

$130 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$10 |

|

Specialist office visit copay |

$45 |

|

Urgent care visits* |

$50 |

|

Emergency care visits* (copay waived if admitted within three days) |

$150 |

|

Lab services per day (not per lab) |

$10 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$3,500 |

|

Inpatient hospital coverage copay per stay

|

$300 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

$150 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: annual initial routine eye exam copay |

$0 |

|

Vision: annual limit for contacts, frames, lenses, and upgrades |

$300 |

|

Hearing: annual routine hearing exam copay |

$25 |

|

Hearing: plan payment every two years for hearing aids |

$1,500 |

|

Dental: annual limit** |

$1,000 |

|

Dental: basic and major procedures (e.g., cleanings, fillings, crowns, and oral surgery) |

Covered 100% |

|

Dental: prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: optional rider for an extra $1,000 coverage |

$48 per month |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

This plan is available in these states and counties:

- Iowa: Allamakee, Fayette, and Winneshiek

- Wisconsin: Buffalo, La Crosse, Monroe, Pepin, and Trempealeau

2026 Gundersen Quartz Medicare Advantage Basic D plan (with Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 Gundersen Quartz Medicare Advantage Basic D plan (with Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 Gundersen Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage

Search for network providers

|

2026 Gundersen Quartz Medicare Advantage (HMO) - Basic D plan (with Rx)

|

|

|---|---|

|

Monthly premium |

$0 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$30 |

|

Specialist office visit copay |

$75 |

|

Urgent care visits* |

$50 |

|

Emergency care visits* (copay waived if admitted within three days) |

$130 |

|

Lab services per day (not per lab) |

$50 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$6,700 |

|

Inpatient hospital coverage copay per day |

Days 1 - 7: $300 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

$375 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: annual initial routine eye exam copay |

$0 |

|

Vision: annual limit for contacts, frames, lenses, and upgrades |

$75 |

|

Hearing: annual routine hearing exam copay |

$40 |

|

Hearing aids |

No coverage |

|

Dental: annual limit** |

No coverage |

|

Dental: Oral exam and prophylaxis (cleaning) once per calendar year |

Covered 100% |

|

Dental: prosthodontics (e.g., removable and fixed |

No coverage |

|

Dental: optional rider for an extra $1,000 coverage |

$59 per month |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

Basic D 2026 prescription drug coverage

Quartz Medicare Advantage has a list of all covered drugs that you can search online or download. The drug list organizes medications into six tiers of costs.

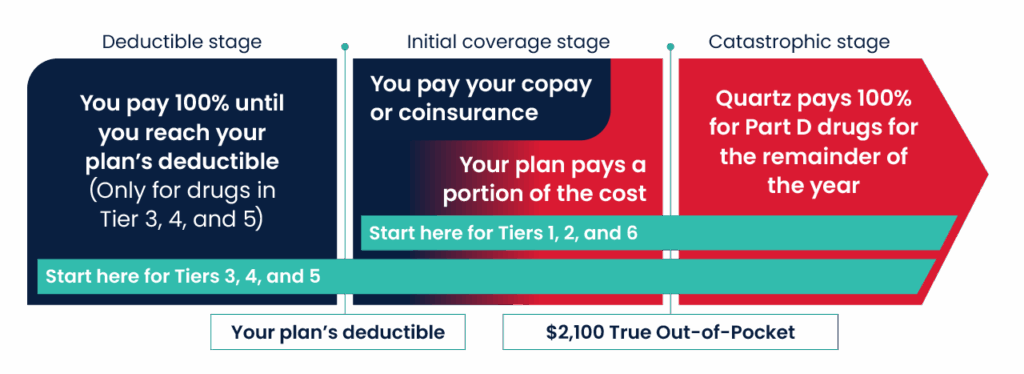

What you pay for prescription drugs in 2026

Your plan has a deductible of $270 for drugs only in Tiers 3, 4, and 5. Deductible does not apply to medications in Tiers 1, 2, or 6. Once you reach the deductible, they are subject to a copay or coinsurance. After reaching the annual TrOOP (True Out-of-Pocket) limit of $2,100, your plan will cover all of your Part D drug costs for the rest of the year. See the image below to learn about the coverage stages.

|

|

Deductible applies?

|

Your share

|

30-day

|

31 to 60-day

|

61 to 100-day

|

|---|---|---|---|---|---|

|

Tier 1 (Preferred Generic) |

× No |

Copay |

$2 |

$4 |

$5 |

|

Tier 2 (Generic) |

× No |

Copay |

$10 |

$20 |

$25 |

|

Tier 3* (Preferred brand) |

✓ Yes |

Coinsurance |

20% |

20% |

20% |

|

Tier 4 (Non-preferred drugs) |

✓ Yes |

Coinsurance |

40% |

40% |

40% |

|

Tier 5** (Specialty) |

✓ Yes |

Coinsurance |

30% retail only |

Not available** |

Not available** |

|

Tier 6*** (Select Care drugs) |

× No |

Copay |

$0 |

$0 |

$0 |

You can fill your prescriptions at any in-network retail or mail-order pharmacy.

*Tier 3 includes many common brand-name drugs, some higher-cost generic drugs, and insulin.

**Tier 5 (Specialty) 30-day supply available in retail locations only. Not available through mail-order pharmacy benefit.

***Tier 6 includes many low-cost medications that treat diabetes, high blood pressure, high cholesterol, osteoporosis, and other conditions.

This plan is available in these states and counties:

- Iowa: Allamakee, Fayette, and Winneshiek

- Wisconsin: Buffalo, La Crosse, Monroe, Pepin, and Trempealeau

2026 Gundersen Quartz Medicare Advantage Core D plan (with Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 Gundersen Quartz Medicare Advantage Core D plan (with Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 Gundersen Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage

Annual Notice of Change | Search for network providers

|

2026 Gundersen Quartz Medicare Advantage (HMO) - Core D plan (with Rx)

|

|

|---|---|

|

Monthly premium |

$29 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$25 |

|

Specialist office visit copay |

$60 |

|

Urgent care visits* |

$50 |

|

Emergency care visits* (copay waived if admitted within three days) |

$130 |

|

Lab services per day (not per lab) |

$20 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$5,900 |

|

Inpatient hospital coverage copay per day |

Days 1 - 6: $270 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

$350 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: annual initial routine eye exam copay |

$0 |

|

Vision: annual limit for contacts, frames, lenses, and upgrades |

$150 |

|

Hearing: annual routine hearing exam copay |

$40 |

|

Hearing: plan payment every two years for hearing aids |

$1,000 |

|

Dental: annual limit** |

$400 |

|

Dental: basic and major procedures (e.g., cleanings, fillings, crowns, and oral surgery) |

Covered 100% |

|

Dental: Prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: optional rider for an extra $1,000 coverage |

$59 per month |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

Core D 2026 prescription drug coverage

Quartz Medicare Advantage has a list of all covered drugs that you can search online or download. The drug list organizes medications into six tiers of costs.

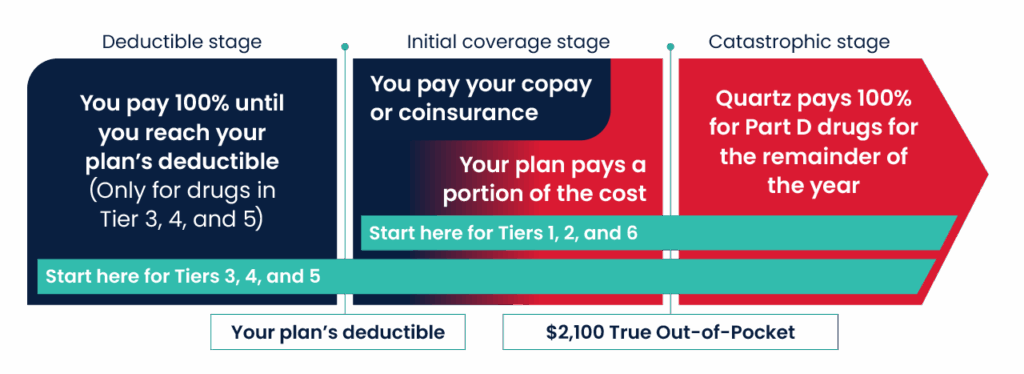

What you pay for prescription drugs in 2026

Your plan has a deductible of $270 for drugs only in Tiers 3, 4, and 5. Deductible does not apply to medications in Tiers 1, 2, or 6. Once you reach the deductible, they are subject to a copay or coinsurance. After reaching the annual TrOOP (True Out-of-Pocket) limit of $2,100, your plan will cover all of your Part D drug costs for the rest of the year. See the image below to learn about the coverage stages.

|

|

Deductible applies?

|

Your share

|

30-day

|

31 to 60-day

|

61 to 100-day

|

|---|---|---|---|---|---|

|

Tier 1 (Preferred Generic) |

× No |

Copay |

$2 |

$4 |

$5 |

|

Tier 2 (Generic) |

× No |

Copay |

$10 |

$20 |

$25 |

|

Tier 3* (Preferred brand) |

✓ Yes |

Coinsurance |

20% |

20% |

20% |

|

Tier 4 (Non-preferred drugs) |

✓ Yes |

Coinsurance |

40% |

40% |

40% |

|

Tier 5** (Specialty) |

✓ Yes |

Coinsurance |

30% retail only |

Not available** |

Not available** |

|

Tier 6*** (Select Care drugs) |

× No |

Copay |

$0 |

$0 |

$0 |

You can fill your prescriptions at any in-network retail or mail-order pharmacy.

*Tier 3 includes many common brand-name drugs, some higher-cost generic drugs, and insulin.

**Tier 5 (Specialty) 30-day supply available in retail locations only. Not available through mail-order pharmacy benefit.

***Tier 6 includes many low-cost medications that treat diabetes, high blood pressure, high cholesterol, osteoporosis, and other conditions.

This plan is available in these states and counties:

- Iowa: Allamakee, Fayette, and Winneshiek

- Wisconsin: Buffalo, La Crosse, Monroe, Pepin, and Trempealeau

2026 Gundersen Quartz Medicare Advantage Value D plan (with Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 Gundersen Quartz Medicare Advantage Value D plan (with Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 Gundersen Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage

Annual Notice of Change | Search for network providers

|

2026 Gundersen Quartz Medicare Advantage (HMO) - Value D plan (with Rx)

|

|

|---|---|

|

Monthly premium |

$90 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$15 |

|

Specialist office visit copay |

$50 |

|

Urgent care visits* |

$60 |

|

Emergency care visits* (copay waived if admitted within three days) |

$150 |

|

Lab services per day (not per lab) |

$15 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$4,200 |

|

Inpatient hospital coverage copay per day |

Days 1 - 6: $250 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

$200 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: annual initial routine eye exam copay |

$0 |

|

Vision: annual limit for contacts, frames, lenses, and upgrades |

$225 |

|

Hearing: annual routine hearing exam copay |

$35 |

|

Hearing: plan payment every two years for hearing aids |

$1,250 |

|

Dental: annual limit** |

$425 |

|

Dental: oral exam and prophylaxis (cleaning) once per calendar year |

Covered 100% |

|

Dental: prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: optional rider for an extra $1,000 coverage |

$48 per month |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

2026 Value D prescription drug coverage

Quartz Medicare Advantage has a list of all covered drugs that you can search online or download. The drug list organizes medications into six tiers of costs.

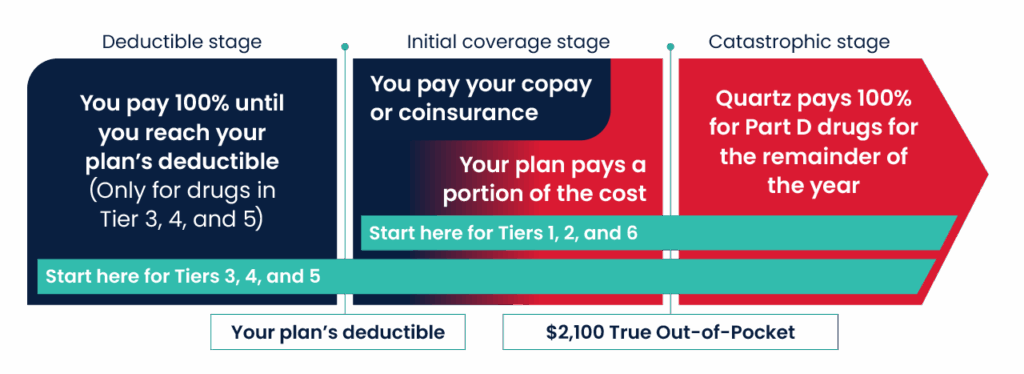

What you pay for prescription drugs in 2026

Your plan has a deductible of $225 for drugs only in Tiers 3, 4, and 5. Deductible does not apply to medications in Tiers 1, 2, or 6. Once you reach the deductible, they are subject to a copay or coinsurance. After reaching the annual TrOOP (True Out-of-Pocket) limit of $2,100, your plan will cover all of your Part D drug costs for the rest of the year. See the image below to learn about the coverage stages.

|

|

Deductible applies?

|

Your share

|

30-day

|

31 to 60-day

|

61 to 100-day

|

|---|---|---|---|---|---|

|

Tier 1 (Preferred Generic) |

× No |

Copay |

$2 |

$4 |

$5 |

|

Tier 2 (Generic) |

× No |

Copay |

$10 |

$20 |

$25 |

|

Tier 3* (Preferred brand) |

✓ Yes |

Coinsurance |

20% |

20% |

20% |

|

Tier 4 (Non-preferred drugs) |

✓ Yes |

Coinsurance |

40% |

40% |

40% |

|

Tier 5** (Specialty) |

✓ Yes |

Coinsurance |

30% retail only |

Not available** |

Not available** |

|

Tier 6*** (Select Care drugs) |

× No |

Copay |

$0 |

$0 |

$0 |

You can fill your prescriptions at any in-network retail or mail-order pharmacy.

*Tier 3 includes many common brand-name drugs, some higher-cost generic drugs, and insulin.

**Tier 5 (Specialty) 30-day supply available in retail locations only. Not available through mail-order pharmacy benefit.

***Tier 6 includes many low-cost medications that treat diabetes, high blood pressure, high cholesterol, osteoporosis, and other conditions.

This plan is available in these states and counties:

- Iowa: Allamakee, Fayette, and Winneshiek

- Wisconsin: Buffalo, La Crosse, Monroe, Pepin, and Trempealeau

2026 Gundersen Quartz Medicare Advantage Elite D plan (with Rx)

Because choosing the right Medicare plan for you is an important decision, we’ve made it easy for you to view highlights of our 2026 Gundersen Quartz Medicare Advantage Elite D plan (with Rx) below. If you’d like to compare plan highlights in your region, you can view or download your 2026 Gundersen Quartz Medicare Advantage plan options.

For full plan details, here are some helpful documents

Provider Directory (Regular print | Large print)

Pharmacy Directory (Regular print | Large print)

2026 Summary of Benefits | Evidence of Coverage

Annual Notice of Change | Search for network providers

|

2026 Gundersen Quartz Medicare Advantage (HMO) - Elite D plan (with Rx)

|

|

|---|---|

|

Monthly premium |

$196 |

|

Preventive services copay |

$0 |

|

Primary care visit copay |

$10 |

|

Specialist office visit copay |

$45 |

|

Urgent care visits* |

$50 |

|

Emergency care visits* (copay waived if admitted within three days) |

$150 |

|

Lab services per day (not per lab) |

$10 |

|

Maximum out-of-pocket (does not include Part D Rx) |

$3,500 |

|

Inpatient hospital coverage copay per stay

|

$300 |

|

Outpatient surgery at Ambulatory Surgical Centers (ASCs) or hospitals |

$150 |

|

Skilled nursing facility copay per day |

Days 1 - 20: $0 |

|

Vision: annual initial routine eye exam copay |

$0 |

|

Vision: annual limit for contacts, frames, lenses, and upgrades |

$300 |

|

Hearing: annual routine hearing exam copay |

$25 |

|

Hearing: plan payment every two years for hearing aids |

$1,500 |

|

Dental: annual limit** |

$600 |

|

Dental: basic and major procedures (e.g., cleanings, fillings, crowns, and oral surgery) |

Covered 100% |

|

Dental: prosthodontics (e.g., removable and fixed |

50% coinsurance |

|

Dental: optional rider for an extra $1,000 coverage |

$48 per month |

*$20,000 annual limit for urgent care, emergency, and transportation services received outside the United States and its territories.

**Receive in-network pricing with providers in the Delta Dental Medicare Advantage Network. Open network access is available with balance billing.

2026 Elite D prescription drug coverage

Quartz Medicare Advantage has a list of all covered drugs that you can search online or download. The drug list organizes medications into six tiers of costs.

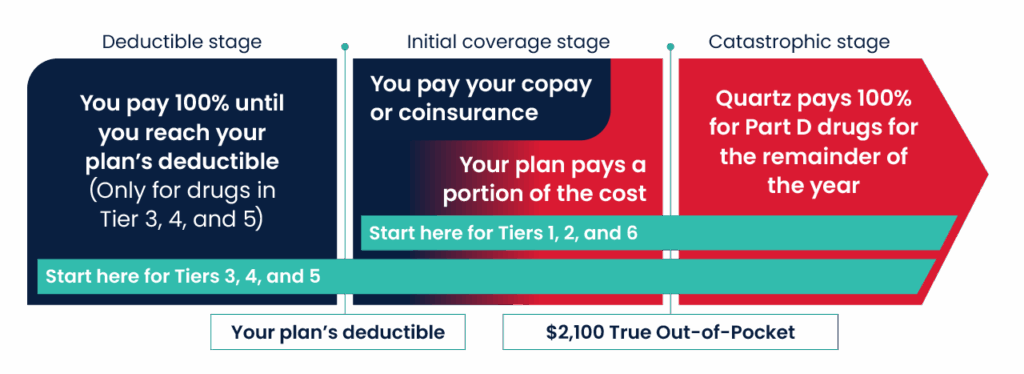

What you pay for prescription drugs in 2026

Your plan has a deductible of $200 for drugs only in Tiers 3, 4, and 5. Deductible does not apply to medications in Tiers 1, 2, or 6. Once you reach the deductible, they are subject to a copay or coinsurance. After reaching the annual TrOOP (True Out-of-Pocket) limit of $2,100, your plan will cover all of your Part D drug costs for the rest of the year. See the image below to learn about the coverage stages.

|

|

Deductible applies?

|

Your share

|

30-day

|

31 to 60-day

|

61 to 100-day

|

|---|---|---|---|---|---|

|

Tier 1 (Preferred Generic) |

× No |

Copay |

$2 |

$4 |

$5 |

|

Tier 2 (Generic) |

× No |

Copay |

$10 |

$20 |

$25 |

|

Tier 3* (Preferred brand) |

✓ Yes |

Coinsurance |

20% |

20% |

20% |

|

Tier 4 (Non-preferred drugs) |

✓ Yes |

Coinsurance |

40% |

40% |

40% |

|

Tier 5** (Specialty) |

✓ Yes |

Coinsurance |

30% retail only |

Not available** |

Not available** |

|

Tier 6*** (Select Care drugs) |

× No |

Copay |

$0 |

$0 |

$0 |

You can fill your prescriptions at any in-network retail or mail-order pharmacy.

*Tier 3 includes many common brand-name drugs, some higher-cost generic drugs, and insulin.

**Tier 5 (Specialty) 30-day supply available in retail locations only. Not available through mail-order pharmacy benefit.

***Tier 6 includes many low-cost medications that treat diabetes, high blood pressure, high cholesterol, osteoporosis, and other conditions.

This plan is available in these states and counties:

- Iowa: Allamakee, Fayette, and Winneshiek

- Wisconsin: Buffalo, La Crosse, Monroe, Pepin, and Trempealeau

Enroll today

If you need help enrolling or finding a plan to fit your needs, we’re here to help.

Ready to enroll: Enroll now

Call a local Quartz Medicare expert:

(888) 346-0886 (TTY:711)

Still have questions?

Attend a seminar